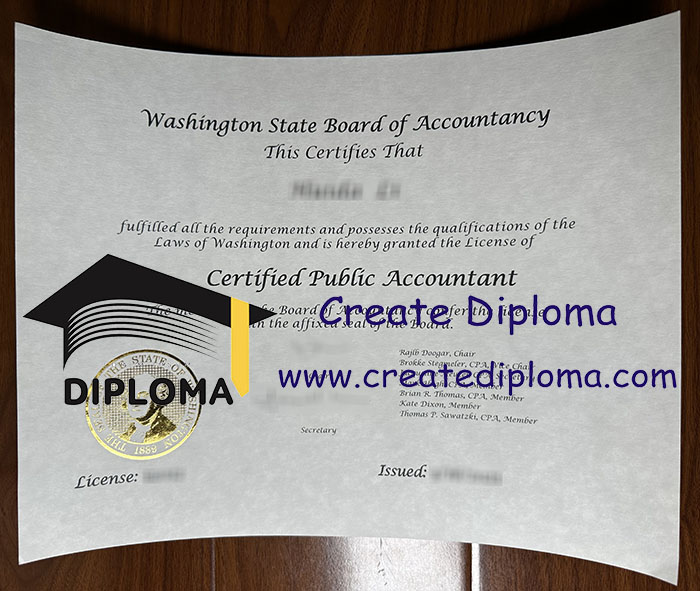

The complete guide to obtain a Washington State CPA certificate. Where to get a realistic Washington State CPA certificate safely? Earning the Washington State CPA (Certified Public Accountant) certificate is a significant achievement that demonstrates expertise, integrity, and mastery in the field of accounting. Recognized as one of the most prestigious credentials in the U.S. accounting profession, the Washington State CPA certificate opens doors to advanced career opportunities in public accounting, corporate finance, government, and consulting—both domestically and internationally.

Administered by the Washington State Board of Accountancy, the CPA certification meets rigorous standards for education, examination, experience, and ethics. To qualify, candidates must complete 150 semester hours of college education, including specific coursework in accounting and business, pass the uniform CPA Exam, and fulfill relevant work experience under the supervision of a licensed CPA. This high bar ensures that every Washington State CPA holder is well-prepared to handle complex financial, tax, and auditing responsibilities.

What makes the Washington State CPA certificate stand out? Washington State offers a CPA license without a residency requirement, making it an ideal choice for out-of-state and international candidates seeking a flexible, reputable U.S. accounting credential. Additionally, Washington does not impose a state-specific ethics exam, streamlining the process for qualified applicants. This accessibility, combined with the state’s strong reputation, makes the Washington CPA a top choice for global professionals aiming to enter or advance in the American accounting market.

Holding a Washington State CPA certificate significantly boosts career prospects. CPAs are in high demand across industries, with roles such as auditor, tax advisor, financial controller, and CFO often requiring or strongly preferring CPA licensure. According to the U.S. Bureau of Labor Statistics, accountants and auditors with CPA certification enjoy higher salaries, better job security, and faster career advancement than non-certified peers.

The benefits extend beyond income. A Washington State CPA certificate grants legal authority to perform audits, sign tax returns, and represent clients before the IRS—privileges not available to unlicensed accountants. It also provides a strong foundation for pursuing additional credentials such as CFA, CISA, or MBA.

Washington State’s commitment to professional excellence, combined with its candidate-friendly licensing process, makes it a leader in CPA certification. With a growing network of accounting firms, tech companies, and financial institutions—including major players like Amazon and Boeing headquartered in the state—CPAs in Washington enjoy abundant opportunities for growth and specialization.