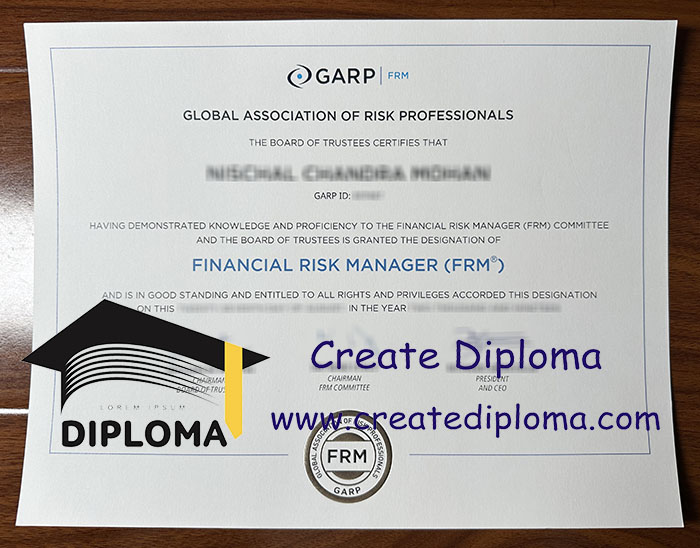

Is it possible to obtain a FRM certificate for a job? Where to get a realistic FRM certificate quickly online? The FRM (Financial Risk Manager) Certificate is one of the most prestigious and globally recognized credentials in the field of financial risk management. Offered by the Global Association of Risk Professionals (GARP), the FRM designation signifies expertise in identifying, assessing, and managing financial risks in today’s complex global markets. Whether you’re aiming for a career in banking, asset management, insurance, or fintech, earning the FRM certificate can significantly boost your credibility, knowledge, and career prospects. This comprehensive guide explores everything you need to know about the FRM certificate, from exam structure to career benefits and global recognition.

What’s the worth of a FRM certificate? Order Financial Risk Manager certificate.

What is the FRM Certificate?

The FRM Certificate is a professional certification for finance professionals who specialize in risk analysis, credit risk, market risk, operational risk, and investment risk. It is designed for individuals working in risk management, compliance, auditing, treasury, and financial regulation. The program is rigorous and covers a wide range of topics, including quantitative analysis, financial markets and products, valuation models, and current issues in financial markets.

The FRM program consists of two parts:

● Part I: Focuses on foundational knowledge in risk management tools and concepts.

● Part II: Delves into practical applications and advanced risk management strategies.

Candidates must pass both exams and have at least two years of professional work experience in financial risk management to earn the full FRM designation.

Why Pursue the FRM Certification?

1. Global Recognition: The FRM is recognized by top financial institutions in over 100 countries, including banks like JPMorgan, HSBC, and Citibank.

2. Career Advancement: FRM holders often qualify for higher-level roles such as Risk Manager, Chief Risk Officer (CRO), Compliance Analyst, and Financial Consultant.

3. Higher Earning Potential: Studies show that FRM-certified professionals earn significantly more than their non-certified peers.

4. Industry Relevance: The curriculum is regularly updated to reflect current market trends, regulatory changes, and emerging risks like climate risk and cybersecurity threats.

Exam Structure and Preparation

The FRM exams are offered twice a year (in May and November). Both parts are multiple-choice and administered via computer-based testing at authorized test centers worldwide.

● Part I: 100 questions, 4-hour duration

● Part II: 80 questions, 4-hour duration

Success requires disciplined study, typically 15–20 hours per week over several months. Many candidates use official GARP study materials, third-party review courses, and practice exams to prepare.

FRM vs. Other Finance Certifications

While certifications like the CFA (Chartered Financial Analyst) and CAIA (Chartered Alternative Investment Analyst) are also respected, the FRM is uniquely focused on risk management. This specialization makes it the top choice for professionals whose primary role involves risk assessment and mitigation.

Degree Authentication and Professional Credibility

The FRM is not a degree, but a professional certification. However, it holds immense weight in the financial industry. Employers and regulators view the FRM as a gold standard for risk expertise. The certificate can be verified through the GARP online directory, ensuring authenticity and enhancing professional trust.

Who Should Consider the FRM?

The FRM is ideal for:

● Risk analysts and managers

● Financial regulators and compliance officers

● Portfolio managers and investment advisors

● Bankers and auditors

● Finance graduates seeking a specialized career path